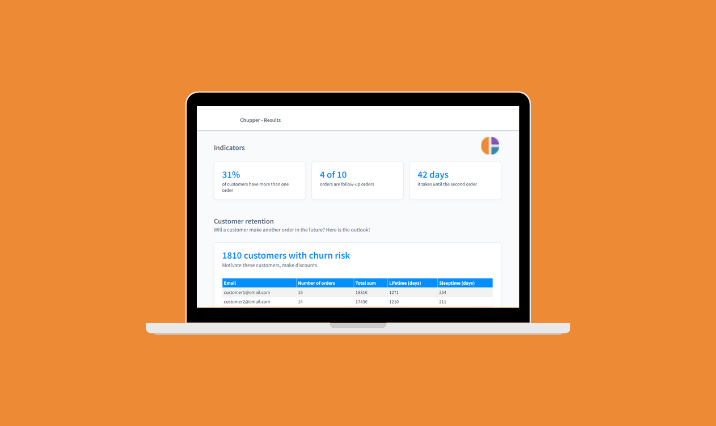

CLV. Customer Lifetime Value

In marketing, a net profit is expected to be generated throughout the customer lifecycle. The CLV valuation model can vary in complexity and accuracy, from rough heuristics to the use of sophisticated predictive analytics techniques.

The problem with CLV valuation is that the endpoint of the customer's lifecycle is unknown in advance, so it is predicted based on current cash flow from the customer.

CLV is an important business concept in the sense that it encourages companies to build long-term relationships with the customer. CLV is an estimate of the cost cap for new customers and is therefore an important element in the calculation of advertising return.

The purpose of CLV valuation is to determine the value of each customer. At the same time, CLV is not equal to customer profitability (the difference between income and costs associated with the customer relationship over a certain period of time). Profitability relates to past periods of the relationship with the customer, whereas CLV looks to the future. While quantitative profitability is associated with reporting and generalizing past performance, CLV quantification is primarily predictive.

CLV can be viewed as the present value of future cash flows from the customer during its relationship with the company. Present value is a discounted amount of future cash flows: Each future cash flow is multiplied by a factor that takes into account the way the value of money is discounted over time.

CLV is the upper limit of what a company is willing to pay to establish a relationship with a new customer or retain an existing one. If we consider customer relationships to be owned by the company, CLV will represent the monetary value of that asset.

If the profit and retention rate is constant, the following formula can be used to calculate the CLV of a customer:

With M (Margin) - profit from the customer, RR (Retention Rate) — probability of customer leaving, DR (Discount Rate) — discount factor.

The model uses three assumptions:

-

If the customer is not retained, he is lost forever.

-

The first profit is obtained at the end of the first period.

-

An infinite horizon is used to calculate the value of future cash flows.

CLV is mainly used in customer-facing sectors such as banking and insurance services, telecommunications, and much of the B2B sector. Different variants of CLV models can be used in the business focused on individual contacts with customers (supermarket purchases, car maintenance etc.).